hotel tax calculator texas

State has no general sales tax. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Call a hotel tax specialist toll-free at 800-252-1385.

. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels. Hotel Tax Calculator Texas. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

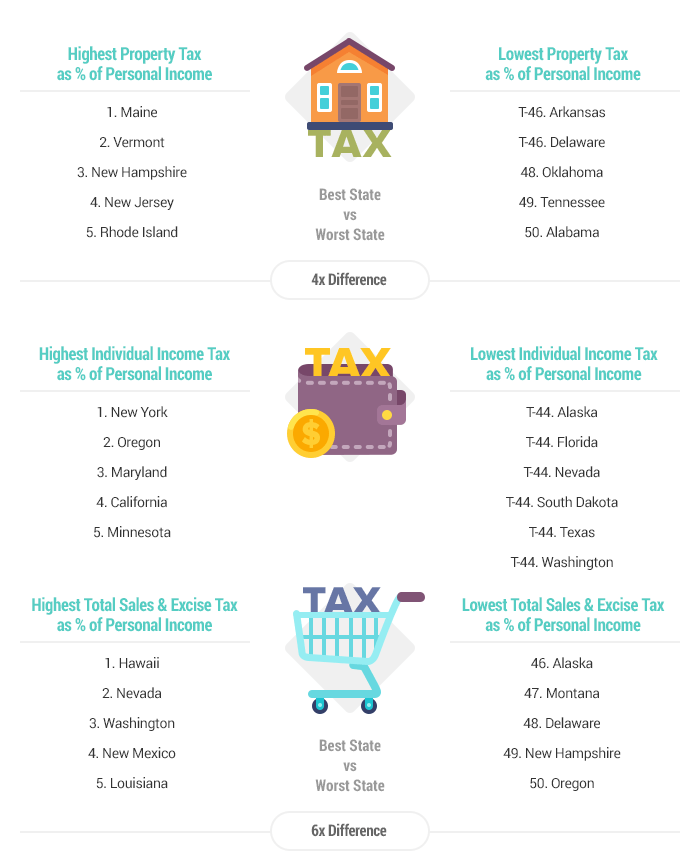

4 Specific sales tax levied on accommodations. Two rate hikes by lawmakers in the 1980s brought it to the present state rate of 6 percent. 7 state sales tax on lodging is lowered to 50.

And if you live in a state with an income tax but you work in Texas. Two rate hikes by lawmakers in the. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms.

The state hotel occupancy tax rate is 6 percent 06 of the cost of a room. Maximum Local Sales Tax. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

Texas Property Tax Calculator. This tool is provided to estimate past present or future taxes. The State of Texas imposes an additional Hotel Occupancy Tax.

Texas State Sales Tax. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. Cities and certain counties and special purpose districts are authorized to impose an additional local.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Average Local State Sales Tax. Maximum Possible Sales Tax.

The City of Austins Hotel Occupancy Tax rate is 11 percent comprised of a 9 percent occupancy tax and an additional 2 percent venue project tax. That means that your net pay will be 45925 per year or 3827 per month. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

Your tax per night would be 1950. Your household income location filing status and number of personal. Hotel and Short Term Rental Tax Calculator.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The calculator will show you the total sales tax amount as well as the county city and. Read Hotel Occupancy Tax Exemptions.

To report and pay your taxes you must log. The british columbia annual tax calculator is updated for the 202223 tax year. Texas law requires that each bill.

The states HOT tax as its often called has been around since 1959 when the Texas Legislature enacted a 3 percent hotel occupancy tax. Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. Use our Tax-Exempt Entity Search.

Cities and certain counties and special purpose districts are authorized to impose an additional local. Our online application process is simple. This is not an official tax report.

Only In Your State. Provincial sales tax pst bulletin. So if the room costs 169.

12-302 Texas Hotel Occupancy Tax Exemption Certificate PDF AP-102 Hotel Occupancy Tax Questionnaire PDF 12-100 Hotel Occupancy Tax Report PDF 12-101 Hotel Occupancy. And all states differ in their.

Thla Staff Author At Texas Hotel Lodging Association Page 6 Of 21

New Texas Rent Relief Program Opens February 15 Texas Apartment Association

![]()

Property Tax Jefferson County Tax Office

Amazon Com Texas Instruments Ti 84 Plus Ce Color Graphing Calculator Black 7 5 Inch Office Products

Short Term Rental Permit And Hot Registration The League City Official Website

Helotes Texas Economic Development Taxes

Texas Hotel Occupancy Tax Receipts And Revenue Database Search Searchtexastax Com

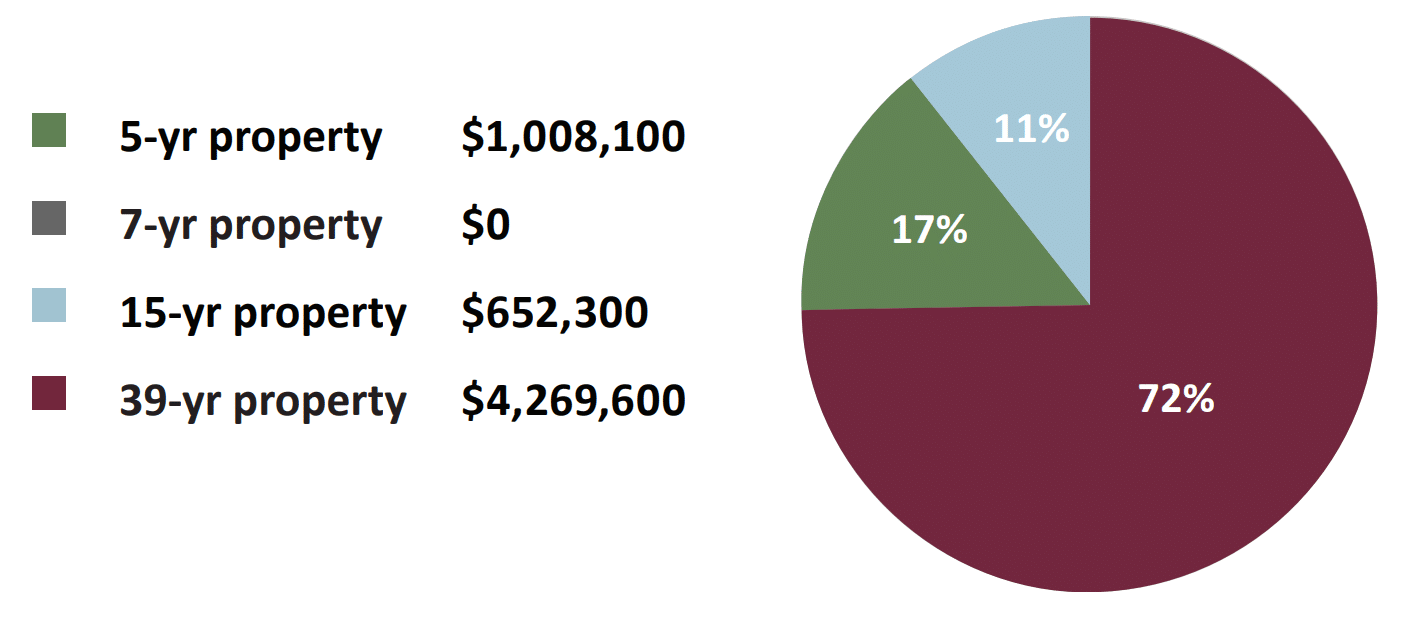

Hotel Cost Segregation Case Study

Texas Income Tax Calculator Smartasset

Property Tax Rates Town Of Little Elm Tx Official Website

Pennsylvania Sales Tax Small Business Guide Truic

Sales Tax Calculator And Rate Lookup Tool Avalara

How Are Property Taxes Calculated In Texas Learn How Property Taxes Are Calculated In Texas With Tax Ease

Traditional Finances City Of Conroe